FAST: Finance, Accounting, Strategy, and Tax #4

July 29, 2025 2025-07-29 7:32FAST: Finance, Accounting, Strategy, and Tax #4

No matter what your dreams are, what business you run, or what you’re passionate about… ultimately, if you cannot make “financial decisions” effectively, your business will always remain uncertain.

The FAST Course: Finance, Accounting, Strategy, and Tax is a 4-week program designed by Pan Pho Company Limited and Mahidol University International College (MUIC) that will take you deep into the principles, thinking methods, and analysis techniques, both theoretical and practical, from experts from leading institutions and companies in Thailand. The content is carefully curated and organized to be easily understood and practically applicable for learners who have no prior background in finance or accounting.

Learn the principles and language of the business world – “Accounting” and “Finance” – through structures and templates that you can actually apply to your business without having to start from scratch. Receive guidance from instructors and experts with experience from various businesses to help you confidently take your “first step” into the world of finance.

“Build a systematic financial foundation to make your business grow steadily in a world of change”

Course Content Throughout 4 Weeks

– Week 1 –

1.Managerial Accounting: Strategies and Decisions

Advance by using accounting information to develop business strategies and decision-making. Learners will learn how to analyze financial and cost data to support effective decision-making, enhancing organizational competitiveness and performance.

- Decision analysis

- Performance measurement and evaluation

- Budget management and financial planning

- Case studies

– Week 2 –

2.Game-Changing Financial Statement Analysis

Develop techniques and skills for financial statement analysis to transform and elevate business. Learners will learn how to read and interpret financial statements to identify opportunities and improve financial performance, enhancing informed decision-making and driving business success.

- Understanding balance sheets, income statements, and cash flow statements

- Using financial ratios for business analysis

- Case studies

3.Strategic Financial Management

Deep dive into strategic financial planning and management to add value to the organization. Learners will learn how to evaluate financial performance and make effective investment decisions for long-term sustainability and growth.

- Investment strategies and asset management

- Capital planning and management

- Fundraising strategies for business growth

- Case studies

– Week 3 –

4.Effective Enterprise Risk Management

Develop systematic enterprise risk management skills. Learners will learn to identify, analyze, and manage risks to protect and add value to the organization, enhancing sustainability and competitiveness.

- Risk management principles and frameworks

- Financial and operational risk management

- Risk assessment and mitigation techniques

- Case studies

5.Value Creation through Business Taxation Management

Reduce expenses and increase revenue legally through effective business tax management to add value to the organization. Learners will learn strategies for tax planning and implementation to reduce tax burden and increase financial efficiency, promoting business growth and sustainability.

- Overview of business tax systems

- Tax planning and management for burden reduction

- Tax laws and regulatory compliance

- Case studies

– Week 4 –

6.Maximizing Value with Financial Feasibility Assessment

Learn important structures for analyzing the financial feasibility of various projects in your business, whether it’s producing new products, opening new branches, new real estate projects, or even increasing machinery investments. Learners will learn how to evaluate costs, returns, and risks to support informed decision-making and add value to the organization.

- Financial feasibility analysis

- Market analysis and investment decisions

- Financial impact assessment of new projects

- Case studies

7.AI in Financial Analysis and Planning

Learn various tools and techniques for applying AI to improve financial data analysis and enhance detailed planning efficiency so you no longer have to make decisions alone.

- Implementing AI in financial analysis and planning

- Hands-on training: Using AI in financial analysis and planning

- Case studies

Note: There may be changes, which will be announced in advance

*************************

Who is this course for?

This course is designed for business owners, new generation executives, and business heirs who:

✅ Want financial knowledge and skills, both theoretical and practical

✅ Have products/services but lack financial knowledge

✅ Want new ideas to expand their organization

✅ Want to manage money systematically

✅ Are looking for advisors and guidance from peers

✅ Manage finances through trial and error and want to start over correctly

✅ Have no financial background or business education but want their business to grow and have competitive advantages ***********************

FAST: Finance, Accounting, Strategy, and Tax

Complete finance and accounting in 4 weeks

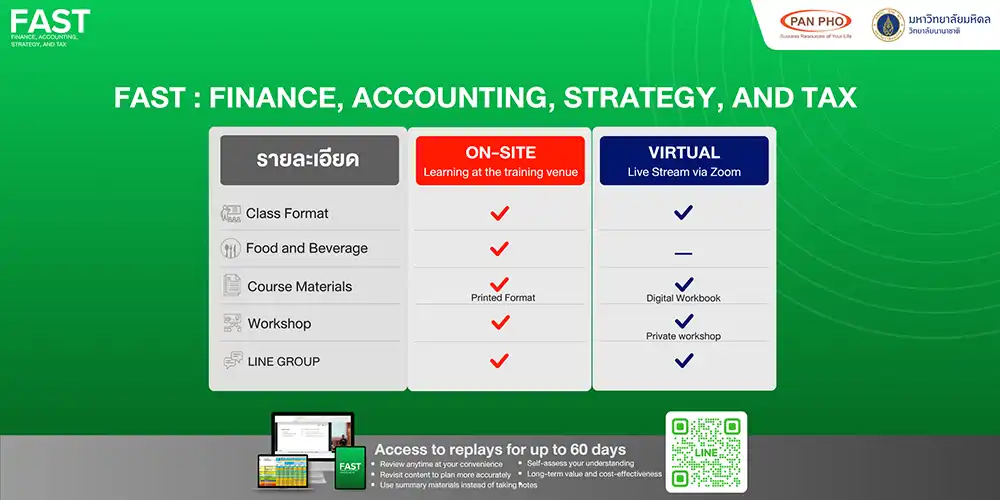

In Hybrid Experiences : On-site & Virtual

Participants can choose from 2 formats:

1.ON-SITE: Learn at Le Meridien Hotel, Bangkok (Limited Seats)

– Includes lunch and refreshments throughout all 4 days

– Includes course folder and study materials

2. VIRTUAL: Live online learning via ZOOM

– Includes digital study materials

**Both formats include access to recorded video sessions for 60 days after completion**

Certificate Requirements

For ON-SITE learners: Receive your certificate on the last day of training at Le Meridien Hotel, presented by instructors from Mahidol University International College. Photo opportunities will be provided during the certificate presentation.

For VIRTUAL learners: Receive your certificate in digital format via email within 2 weeks after completing the training.

***********************

For more details and registration:

WEBSITE: https://panphogroup.com/smart

LINE: @PANPHO

TEL: 094-242-4197