Please choose a news and article category.

Recent MUIC Events

CUHK Business School Master’s Programmes 2026

Registration Schedule Summer Session 2024 – 2025

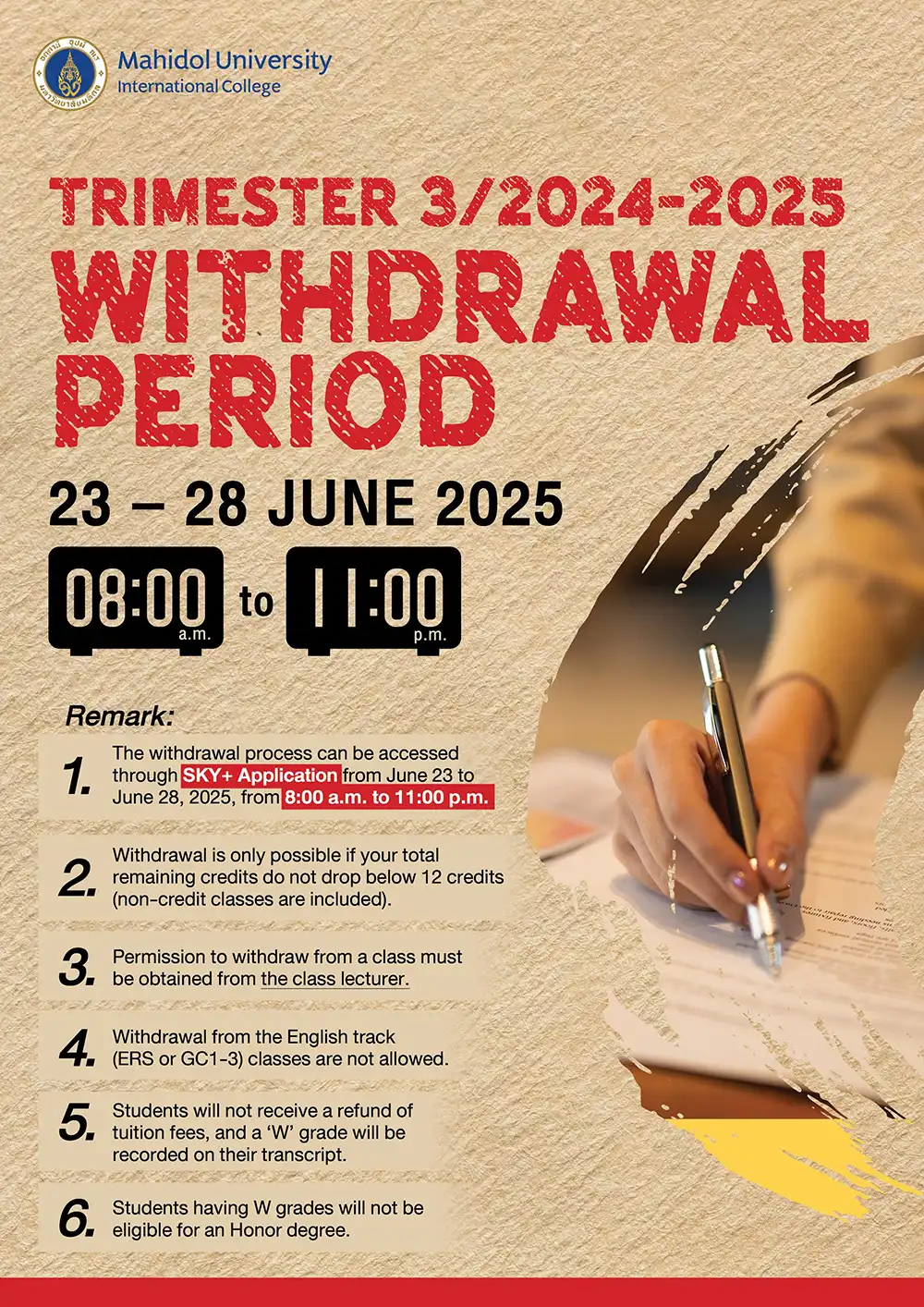

Withdrawal Period for Trimester 3/2024-2025

Gender Festival 2025

MUIC 360 Degrees

The Crypto-Metaverse and Digital Real Estate

August 22, 2023 2025-02-10 2:18The Crypto-Metaverse and Digital Real Estate

By Dr. Aman Saggu

What is the Crypto-Metaverse?

Once a science fiction dream, the crypto-metaverse is now a reality. A decentralized online world, created through the fusion of virtual and physical reality, where users explore, interact, and trade virtual items such as land, clothing, and other assets, all represented as non-fungible tokens (NFTs). Powered by blockchain technology, it ensures unique ownership and trading, with cryptocurrencies often used to pay for goods, services, and other activities. The crypto-metaverse is not just a game, it is a USD $7 billion industry today!

The Glamorous Streets of the Crypto-Metaverse

In the crypto-metaverse, companies are not just reaching out to customers; they are creating spaces where unique and immersive experiences become reality. Skateboard down the bustling virtual streets of Vans World, or glide on ice through the luxurious Ralph Lauren Winter Escape on Roblox. Join exclusive parties at Paris Hilton‘s virtual mansion on The Sandbox, or embrace the world of haute couture from a front-row seat at Dolce & Gabbana‘s fashion show on Decentraland.

Investors in the crypto-metaverse are not just buying virtual land; they are acquiring status, prestige, and unique ties to landmarks and celebrities. For instance, a $450,000 plot was purchased next to Snoop Dogg’s virtual mansion in The Sandbox in December 2021, and a digital plot in the Otherside metaverse sold for $1.57 million in May 2022. Within the metaverse, properties’ values rise near landmarks, busy streets, notable addresses, and famous owners, mirroring the ‘real world.’

Four Core Motivations: Why Do Retail Investors Buy Metaverse Land?

Why are regular individual, or retail, investors choosing to buy metaverse real estate, just like wealthy investors? To explore this question, Mahidol University, in collaboration with Blockchain Research Lab and CoinGecko, conducted a survey of retail investors. The study revealed four distinct motivations driving investment in virtual real estate, highlighting that this emerging trend is not exclusive to the affluent but resonates with a broader audience:

- Aesthetics & Identity: The Artistic Soul

- These retail investors artistically wield their creativity to sculpt exclusive styles and virtual selves, converting their artistic zeal into digital enterprises. They accentuate the importance of forging an online identity and experiences that can be turned into revenue streams.

- Social & Community: The Social Connectors

- Centering on shared experiences and virtual property, these retail investors elevate social prestige and target tangible community objectives. They cultivate worldwide connections and respond to the inherent desire for digital camaraderie and recognition.

- Speculation & Investment: The Calculating Traders

- Viewing the metaverse as a financial battleground, these retail investors play both rapid-fire profit games and long-haul strategies in digital property. This fresh playground caters to a spectrum of financial tactics and thinking.

- Innovation & Technology: The Technological Trailblazers

- Attracted by the allure of technological exploration and groundbreaking possibilities, these retail investors draw those looking to probe, redefine, and welcome a tech-dominant future, where innovation is not just encouraged but celebrated.

Demographic Influence: Age, Education, and Risk Profiles

Investment patterns within the crypto-metaverse are influenced by demographic factors such as age, education, and risk tolerance. The observed behaviors reveal a complex interplay of motivations and interests that challenge stereotypes and assumptions.

- Older Investors: Tend to be drawn to 2. Social & Community and 4. Innovation & Technological aspects, contrary to expectations that they might prefer traditional avenues.

- Higher Education: Surprisingly tend to avoid 2. Social & Community focused investments, contradicting the assumption that they would naturally be drawn to social dynamics.

- Risk-takers: Consistent with their profile, are attracted to the 3. Speculation & Investment aspects of investment.

Implications for Developers, Investors, and Policymakers

The insights from this research into individual motivations and behaviors in the crypto-metaverse enable tailored approaches that benefit stakeholders:

- Developers can craft personalized experiences that resonate with user needs, leading to higher satisfaction and retention within the metaverse.

- Investors can align their strategies with specific user demographics, allowing for a more nuanced approach to balancing risks and rewards in their financial strategies.

- Policymakers can guide the digital economy by creating targeted regulations that protect and support different types of investors, fostering innovation, and maintaining safeguards.

Reference: Ante, L., Wazinski, F. P., & Saggu, A. (2023). Digital Real Estate in the Metaverse: An Empirical Analysis of Retail Investor Motivations. Finance Research Letters Vol. 58 Part A, 104299. https://authors.elsevier.com/c/1hbcJ5VD4Kr1Zu

All digital images credited to the author.

About the Author

Dr. Aman Saggu, B.S., M.S., Ph.D., is a Lecturer in Cryptoeconomics and Banking at Mahidol University International College; Research Fellow at the Blockchain Research Lab; and Research Fellow at Blockhead.co