Please choose a news and article category.

Recent MUIC Events

Special Talk on Foreign Policy of Peru and Peru-Thailand Relations

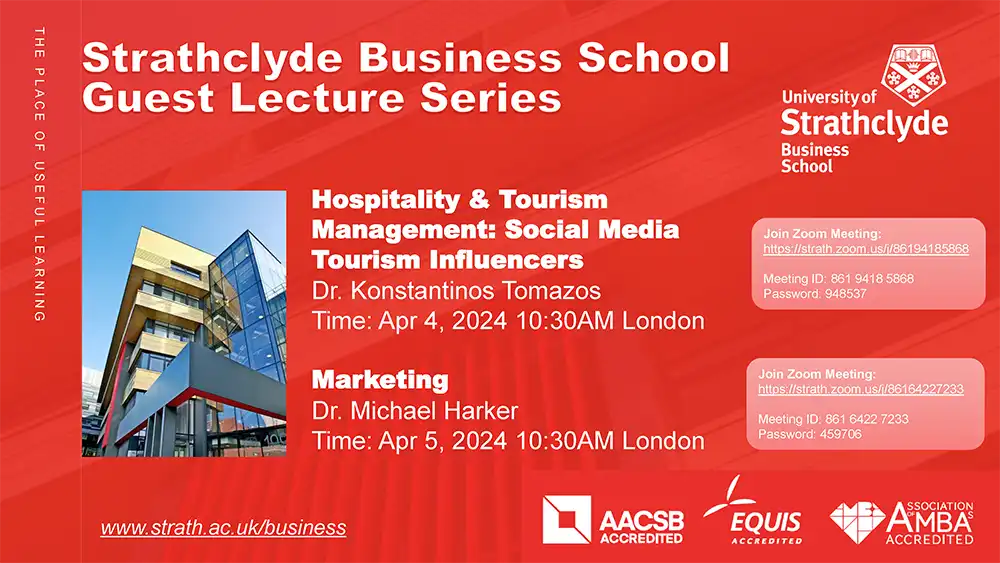

Online Guest Lectures by University of Strathclyde, Business School, UK

MUIC’s 38th Anniversary

MUIC 360 Degrees

Blockchain-Based Fan Tokens: Riding the World Cup Wave

March 25, 2023 2024-03-25 4:47Blockchain-Based Fan Tokens: Riding the World Cup Wave

By Dr. Aman Saggu

What is a Fan Token?

Fan tokens are digital assets created on blockchains by elite sports clubs (e.g., FC Barcelona and Manchester City), prominent sports franchises (e.g., Formula 1 and the Davis Cup), and car industry titans (e.g., Aston Martin and Alfa Romeo). Investors can buy fan tokens of their favorite football clubs and get voting rights on specific organizational initiatives, alongside access to rewards and engagement activities. The fan tokens can be traded like other cryptocurrencies. As of March 2023, the fan token market is worth over USD 460 million.

What Happened to Fan Tokens During the World Cup?

As the six-month build-up to the 2022 FIFA World Cup reached a fever pitch, football-related fan tokens witnessed a meteoric rise. Argentina’s (ARG) token skyrocketed by 953%, Portugal’s (POR) escalated by a remarkable 1,038%, and Brazil’s (BFT) rose 324%. At the same time, cryptocurrencies were in a bear market—a period of sharply declining prices— made worse by the bankruptcy of the FTX cryptocurrency exchange which saw panic selling.

Bridging the Gap Between Football Teams and Financial Markets

Researchers have seen a fascinating trend: When a national football team loses in the World Cup, the stock market in that country usually declines the next day because investors are disappointed. However, these estimates can be biased. The main problem is national teams do not sell shares on stock markets, and stock markets only trade shares at specific times, so we did not know how the actual share prices of national football teams would be affected by the team losing. In contrast, fan tokens trade 24/7 and are issued directly by national football teams. For the first time, we can analyze how football match performance affects financial markets while the matches happen!

Crucial Insights Unearthed

Delving into the World Cup’s tidal effects on fan tokens, new research paints a fascinating picture:

- Pre-Game Euphoria: Fan tokens surge the hour before kickoff, aligning with the ‘anticipation effect’—as investors rally behind potential victors—their preferred team.

- Match Dynamics: Fan token prices decline as matches advance, especially during halftime and as the final whistle looms.

- Victory and Defeat: Victories spark increased trading activity but stabilize token prices as buyers and sellers clash in equilibrium, with fans holding onto their tokens in celebration. In contrast, losses prompt rapid sell-offs

- Amplified by Anticipation: Losses in critical matches such as the round of 16, semi-finals, or finals dramatically slash fan token values by -50.74% to -59.43%, especially in knockout scenarios.

- Traditional Wisdom Rings True: Resonating with the age-old mantra—”buy the rumor, sell the news”—tokens rise before matches but face a downtrend as events unfold.

Guidance for Stakeholders:

The volatility and fervor around fan tokens, intensified by events like the World Cup, offer crucial takeaways:

- For Investors: Astute observation and strategic planning can convert match schedules into potential goldmines, ensuring calculated risks and informed decisions.

- For Fans: Beyond the allure of potential profits, fan tokens provide a novel avenue to connect and influence one’s favorite teams. Yet, they remain, at their core, financial tools—with the inherent volatility of the crypto world.

- For the Wider Cryptocurrency Landscape: The buzz around specialized tokens highlights the flexibility and evolution of the crypto domain, emphasizing the necessity for comprehensive education on these emerging digital frontiers.

Reference: Saggu, A., Ante, L., & Demir, E. (2024). Anticipatory Gains and Event-Driven Losses in Blockchain-Based Fan Tokens: Evidence from the FIFA World Cup. Research in International Business and Finance, Volume 70, Part A, 102333. https://doi.org/10.1016/j.ribaf.2024.102333.

About the Author:

Dr. Aman Saggu, B.S., M.S., Ph.D., is a lecturer in Crypto-economics & Banking at Mahidol University International College.